Money flows into currency pairs for a number of reasons, Political unrest, speculation, import & export activity to name a few. However, one of the most influencing activities within economics that helps to attract flows into a currency pair is interest rate hikes. This stems from the dynamics of the banking system and an economic principle known as “Hot Money Flows.”

Hot money flows are the flow of money from one currency into another in the pursuit of higher interest rates. When choosing to save money in a bank account, savers would often choose the account with the highest interest rate in order to make the most returns on their savings. This higher rate of return can be found in bank accounts abroad which prompts individuals/companies with large sums of capital to convert their currency and deposit this capital into the foreign bank account. This conversion of currency requires the selling of one currency and the buying of another one.

For example: If a UK bank account is offering an interest rate of 3% per annum and a bank account in the United States is offering 7%, “Hot Money Flows” would suggest that you are better off putting your money in the US bank account. If you had £10,000,000 and you wanted to put this into a US bank account, this GBP amount would be sold and the equivalent dollar amount (subject to conversion rate) would be bought and deposited into a US account. As a result of this process the outcomes are the following: There is a greater supply of GBP on the FX market (£10,000,000 more), there is less USD on the global FX market and the individual/company is realising a higher rate of return in the US bank account at 7% as opposed to 3% in the UK.

2022 saw the US beginning an aggressive rate hike cycle in order to tame inflation. As a result of this, the dollar gained in strength against a number of other major currency pairs. Below is USD’s performance against GBP and the circles represent the individual rate hikes that took place from last year to now.

The Impact of Interest Rate Hikes on FX Currency Pairs

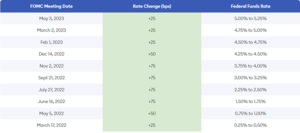

Schedule of these rate hikes:

At the beginning of this rate hike cycle back in March 2022, GBPUSD was trading at 1.30. Over the course of this cycle, GBP declined in value against USD and even reached as low as 1.03 in late September 2022 (this is the lowest the currency pair has ever traded).

To summarise, in periods of high interest rates, countries offering higher rates of interest will benefit from “Hot Money Flows” and ultimately see strength reflected in their currency. This is especially true when comparing countries that offer a low interest rate in comparison to countries that offer higher rates.

Learn with the blokes