Before we talk about the importance of having stop losses and take profits and what hard stops and soft limits are for those unaware, firstly I will define exactly what a stop loss is and take profit is.

What is a stop loss?

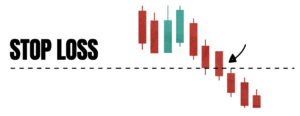

A stop loss is when a trader will place an order to automatically sell their position (assuming they are long an asset) or automatically buy back a position (assuming they are short an asset). The stop loss can be set at a monetary value to the trader’s position and or can be set at a market price, but the order will always be received as a market price not the monetary value. For example, instead of placing a stop loss of $1000, a trader will place their stop relative to the asset value. On EURUSD this might be 1.0450. even though if the trade closes at 1.0450 with a $1000 of loss the stop loss order level will be 1.0450.

What is a hard stop and a soft limit?

A hard stop loss will automatically trade out of the position in full value. All the risk exposure will be taken off and the trade will be completely closed leaving the trader with no exposure to that trade.

A soft limit on the other hand is one that you may close a portion of the trade automatically or none of it, but you will have set an alert either through a charting system or through the brokerage account to alert you that your initial target has been reached. A hard limit would mean that the full position closes automatically with the trader receiving the profits.

What is the importance and advantage of having a hard stop and soft limit?

As traders we seek certainty and those trading long enough will know it doesn’t exist, but we can ensure certainty within our risk. I will cover another blog or video within the two blokes trading app on risk management later. For now, if we can ensure that our stop losses are hard, then we can say with certainty the maximum that can be lost on a trade is $X. Having a hard stop loss along with discipline will ensure that we don’t break our risk parameters and risk blowing up our account.

Let’s also touch upon what I said previously, it brings certainty and why is that so important? Well for that we need a situation: Say you are long the SPX index and your max stop loss is $1000 (nominal), and you have a soft stop loss. Negative news comes out and now your P&L is down $1500… what do you do? Buy more to lower the average price, hold, or sell it? Let’s say you hold or buy more. Price the next day drops further and you are down $2000, what do you do? Buy more, hold, or sell it all? Fast forward you are now down $5000. By now I think you get the point, you will have wished you took the certainty and took the $1000 loss and walked away. Therefore, we always seek certainty, if we are comfortable with the $1000 loss before we initiate the trade and this is within our risk parameters then if the stop loss does get triggered, we won’t mind.

Take my word for it, if you do this for 1 position and it is your only position within your account, then as a naïve retail trader you might think you are “just increasing your risk which you are prepared to do”. But if you are trading a portfolio with multiple equities or multi assets and you do this, you will be wiped out before you can even get logged on. Therefore, I always stress when we are getting paid, take risk and when we are paying the market, take certainty.

Why do we want a soft limit and not a hard limit?

If price reaches our limit, it has done so for a reason, because we are right on the direction and have executed the trade well with our macro view aligning. Therefore, it’s only right at the trader’s discretion that they decide where the trade should go from here. Let’s take another example. Say you believe the SPX will fall in the coming period and you enter a well-timed short position. You risk $1000 and your unrealised P&L is now $3000 (3:1) we now have a few options. Firstly, we can close the trade fully with $3000 profit and walk away, secondly, we can close part of the trade and let the trade run as we wind down our stop loss just like a trailing stop. We could then be up $5000/$6000 before getting cut out. I assume many of you who have traded have said “I wish I held onto that longer, I would have had double the profit”. This is a common occurrence so therefore when we are right, we seek risk and when we are wrong, we seek certainty.

I will also stress not to be too greedy in markets but just remember, if you are being sensible, you can take more risk without necessarily taking more risk. This is a form of risk management I will go into a lot more detail with our premium members very soon.

Enjoy the Christmas Period,

Rory

Download the two blokes trading app for market breakdowns, analysis, trade ideas, education and more.